America’s economy fell off a cliff during the lockdown. The recovery won’t come easily.

But this is no ordinary recession. The combination of public health and economic crises is unprecedented, and numbers cannot fully convey the hardships millions of Americans are facing.

Consumer spending, the biggest driver of the US economy, declined at an annual rate of 34.6% — by far the sharpest decline on record.

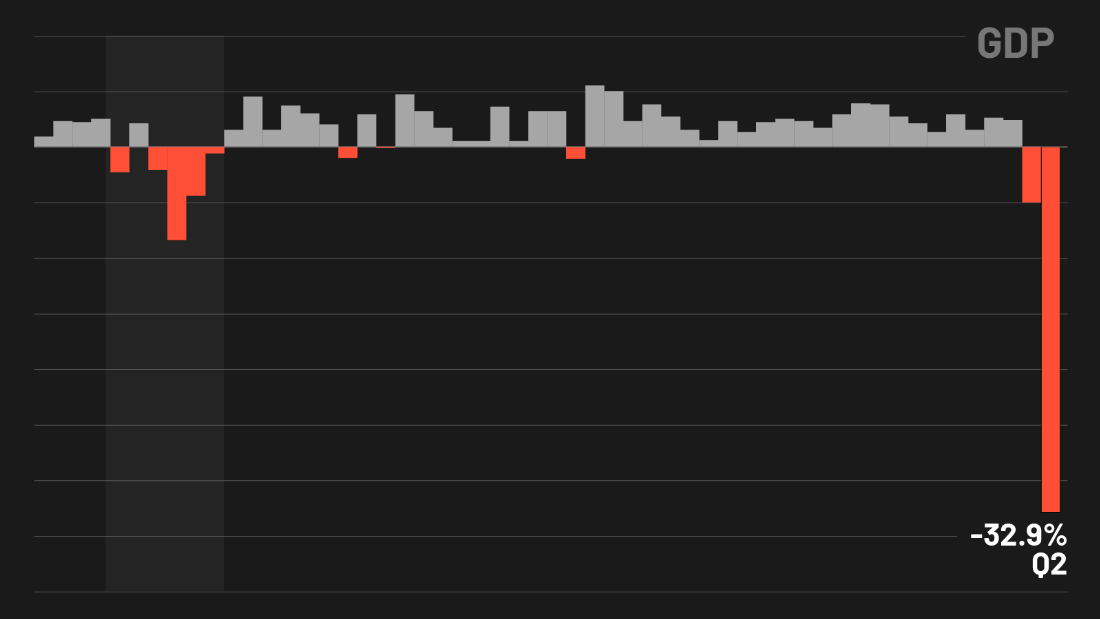

The worst quarter ever

The pandemic pushed the economy off a cliff. The second-quarter GDP drop was nearly four times worse than during the peak of the financial crisis, when the economy contracted 8.4% in the fourth quarter of 2008.

Quarterly GDP numbers are expressed as an annualized rate. This means that the economy didn’t actually contract by one-third from the first quarter to the second. The annualized rate measures how much the economy would grow or shrink if conditions were to persist for 12 months.

Not annualized, GDP declined by 9.5% in between April and June, or by $1.8 trillion.

But by either measure, it was still the worst quarter on record.

The US only began keeping quarterly GDP records in 1947, so it’s difficult to compare the current downturn to the Great Depression. That said, in 1932 the US economy contracted 12.9%.

Earlier quarterly declines also pale in comparison to this year.

Between April and June of 1980, the economy contracted at an annual rate of 8% on the heels of rising oil prices and restrictive monetary policy to control inflation.

America’s small businesses are struggling

The pandemic shutdown of the past spring hardly left anyone in America untouched. Businesses sent their employees home, shops shuttered and schools closed.

In the hard-hit hospitality sector, which lives of the face-to-face interactions that coronavirus has rendered risky, things are even harder.

Don Zelek, who owns an the 1825 Inn Bed and Breakfast in Pennsylvania, doesn’t believe things will go back to normal until spring 2021. A lack of tourists amid quarantine restrictions on travel is weighing on local economies.

“Like most, we have come to terms with the fact that this will be at least a yearlong event,” Zelek said. “Early on, I thought this may be a three-month event, silly me.”

Meanwhile, workers dependent on in-person contact, including those working in events are at a loss about how they will make it through the summer.

Many small business owners feel forgotten by the government, while larger companies have more options to make it through the crisis. And while many businesses have shifted to online sales and offerings, local, smaller companies have found the uptake didn’t help them make enough money to stay afloat.

The recovery won’t come easily

Washington has deployed trillions of dollar in monetary and fiscal stimulus to help the country through the recession. Loan programs for companies, expanded unemployment benefits and checks sent directly to many Americans were designed to get the economy back on track as quickly as possible.

While that would be good news, it doesn’t mean the crisis is over.

Clarification: An earlier version of this article failed to specify that the 32.9% contraction is measured at an annualized rate.

![]()