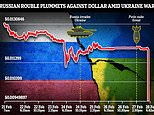

Rouble falls to lowest level EVER after 30% overnight plunge against dollar

Russian Central Bank hikes interest rates to TWENTY per cent in desperate bid to stop rouble crash: Currency fell 30% overnight to all-time LOW against US dollar as Western sanctions savage economy amid floundering invasion

The Bank of Russia raised key interest rate from 9.5 per cent to 20 per cent todayThe rouble dropped to as low as 119 per dollar in early trading Monday morningIt tumbled beyond its previous low of 90 roubles per dollar – with it last at 109Meanwhile the dollar soared against most others as the war on Europe raged on

<!–

<!–

<!–<!–

<!–

(function (src, d, tag){

var s = d.createElement(tag), prev = d.getElementsByTagName(tag)[0];

s.src = src;

prev.parentNode.insertBefore(s, prev);

}(“https://www.dailymail.co.uk/static/gunther/1.17.0/async_bundle–.js”, document, “script”));

<!–

DM.loadCSS(“https://www.dailymail.co.uk/static/gunther/gunther-2159/video_bundle–.css”);

<!–

Russia’s central bank has hiked interest rates as it desperately tries to stop the rouble crashing amid crippling sanctions from the West over the brutal invasion of Ukraine.

The Bank of Russia raised its key interest rate from 9.5 per cent to 20 per cent this morning because ‘external conditions for the economy have drastically changed,’ its board of directors said.

Top economists and the finance ministry also ordered exporting companies to sell 80 per cent of their foreign currency revenues on the market to try to support the rouble.

It comes as the Russian economy plummeted 30 per cent overnight to an all-time low as the West’s sanctions over the Ukraine war start to squeeze the economy.

The dramatic changes have already seen Russians racing to cash machines and queuing for hours to try to withdraw their savings.

The West imposed sanctions on Vladimir Putin’s country after he launched a brutal war on neighbouring Ukraine last week, with the UK, US and EU cranking up restrictions in recent days.

Meanwhile the despot’s forces have so far failed to swiftly take over the country after a ferocious fightback from President Volodymyr Zelenskyy’s troops.

Russian and Ukraine negotiators are today meeting at the Belarus border amid hopes for peace just a day after Putin put his nuclear deterrent forces on ‘alert’.

The Russian rouble has plummeted to an all-time low as the West’s hefty sanctions over the Ukraine invasion start to squeeze the economy

The currency dropped to as low as 119 per dollar (pictured over the last day) in early trading, tumbling beyond its previous low of 90 roubles per dollar. It was last at 109

The changes came despite Russia’s central bank announcing a slew of steps yesterday to support domestic markets. Pictured: The rouble against pound sterling over the last day

The Bank of Russia hiked the key rate from 9.5 per cent to counter risks of rouble depreciation and higher inflation and also ordered companies to sell 80 per cent of their foreign currency revenues.

It said: ‘External conditions for the Russian economy have drastically changed.’ It added the hike ‘will ensure a rise in deposit rates to levels needed to compensate for the increased depreciation and inflation risk.’

Monday’s steps bolster other measures announced on Sunday, which include the central bank’s assurance it would resume buying gold on the domestic market.

It also said it would launch a repurchase auction with no limits and ease restrictions on banks’ open foreign currency positions.

And it increased the range of securities that can be used as collateral to get loans and ordered market players to reject foreign clients’ bids to sell Russian securities.

Central Bank Governor Elvira Nabiullina is set to hold a briefing at 1pm GMT, the bank said in its statement on Monday.

Western allies have ratcheted up sanctions on the country, including blocking certain banks from the SWIFT international payments system. Pictured: A delivery man in Moscow on Thursday

It comes after the rouble dropped to as low as 119 per dollar in early trading, tumbling beyond its previous low of 90 roubles per dollar, having last been at 109, while the dollar soared.

Western allies have ratcheted up sanctions on the country, including blocking certain banks from the SWIFT international payments system.

Restrictive measures on the Bank of Russia were also imposed to prevent it from deploying its international reserves to undermine sanctions.

Adding to nerves, Vladimir Putin put Russia’s ‘deterrence forces’ – which wield nuclear weapons – on high alert.

People on the ground in Russia were already feeling the squeeze as Russians yesterday started racing to cashpoints as ‘panic started’.

Russian economist Vladislav Zhukovskiy told the Telegraph: All over the country there are queues at ATMs to withdraw money.

‘Banks are selling the dollar at 100 to 120 roubles. Where are [central bank chief] Elvira Nabiullina and [prime minister] Mikhail Mishustin?’

Sberbank sent out alerts to customers early yesterday telling them the bank was ‘operating normally’. In Khimki, near Moscow, a shopping mall had a huge queue running through it as rucks of people waited for an ATM.

Visitors to the capital were asked if they would pay their hotel bills before leaving in case their cards will not work next week.

Billionaire US hedge fund manager Bill Ackman said: ‘If I were Russian, I would take my money out now. Bank runs could begin in Russia on Monday.’

Deputy Chief Economist at the Institute of International Finance Elina Ribakova said: ‘Bank runs have started from the very first day of sanctions and have accelerated over the weekend.’

Elsewhere, the euro tumbled 1.1 per cent to $1.1148. It was also down 1 per cent on both the yen and the Swiss franc.

But the dollar was the main winner of the tension around Ukraine. The dollar index, which measures the currency against six peers, was up 0.83 per cent at 97.368.

The greenback even gained a fraction on the yen, which was at 115.53 per dollar.

Adding to nerves, Vladimir Putin (pictured yesterday) put Russia’s ‘deterrence forces’ – which wield nuclear weapons – on high alert

Carol Kong, an FX strategist at Commonwealth Bank of Australia, said: ‘In the near term we think the dollar faces a risk of pushing above the 97.47 resistance level.’

She said the extent of the dollar’s gains would depend on any further leap in volatility, the size of the sell-off in global equities, and assessments of central banks’ tightening programmes.

She noted high energy prices were capping the yen, given Japan imports the bulk of its energy requirements.

Markets are now pricing in a 95 per cent chance the US Federal Reserve will hike rates by 25 basis points at its March meeting, according to CME’s Fedwatch tool, with the invasion having put an end to speculation that the Fed will jump in with a 50 basis point hike.

Investors also believe the war will deter the European Central Bank from any strong tightening moves in the near term.

The Australian dollar slid 0.72 per cent to $0.7180, the New Zealand dollar sank 0.76 per cent to $0.6685, and sterling was slightly weaker at $1.335.

A top official at the Reserve Bank of New Zealand told Reuters in an interview it is too early to assess what impact, if any, the Russian invasion of Ukraine might have on policy, and that it has more work to do on interest rates to control inflation.

In cryptocurrency markets, bitcoin was in the middle of its recent range, trading just below $38,000.

![]()